Knowing what a physical asset is worth – its value – can be very useful both for financial reporting and for supporting asset management. Even if the notion of asset value is somewhat abstract, an asset owner generally prefers that the value of their assets increases or at least remain constant over time. Fundamentally, tracking and reporting asset value helps a transportation agency monitor the state of its assets and provides a sense of whether the inventory is improving or in a state of decline. Transportation agencies use data on asset value in a variety of ways to support asset management. Major applications of asset value aiding an overall asset management program are described below.

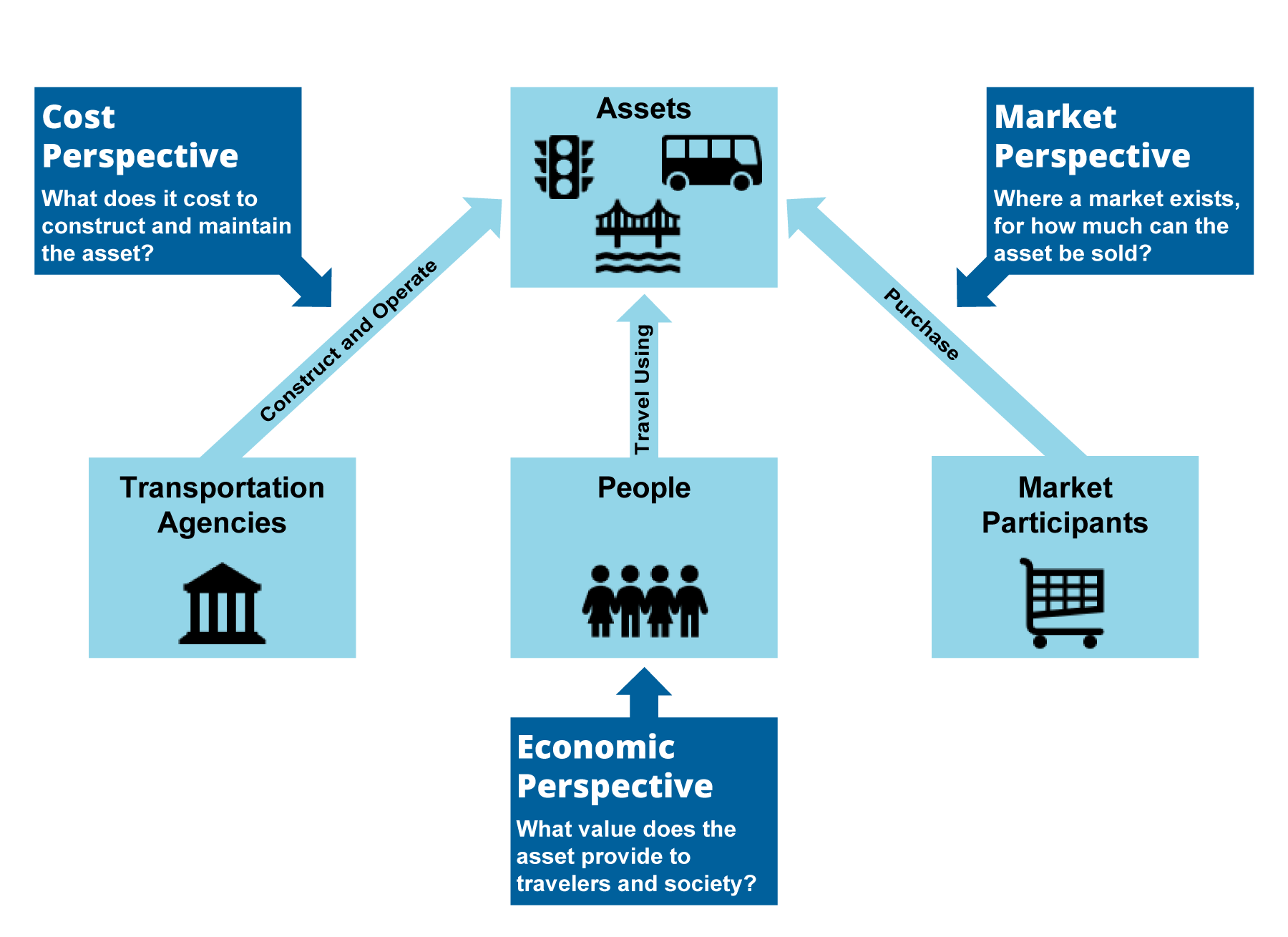

Asset value is a number, ascribed to an asset, which explains the benefits the asset yields to a stakeholder. Key stakeholders in transportation asset management include asset owners, transportation system users, society as a whole, and other market participants. Each of these stakeholders has a unique perspective on asset value, captured in the three perspectives described in this section: cost, market, and economic perspective.

This section outlines the basic steps in calculating asset value. Though they are intended to support the different applications described in Section 2.1, the steps are the same regardless of the specific application, and regardless of which perspective described in Section 2.2 one assumes. The steps explicitly acknowledge the different applications and perspectives, and they walk the analyst through the key decisions for calculating asset value. Figure 2-5 summarizes the steps to calculate asset value, and the following subsections describe each step further.

There are different accounting standards in the U.S. and internationally for valuing assets for the purpose of financial reporting. These standards describe best practices in accounting that agencies should carefully consider when valuing assets to support TAM. However, particularly in the U.S., the approach an agency uses to value assets for TAM often differs from that used for financial reporting. The following subsections provide further detail on U.S. standards and international standards, and the applications of these standards to support TAM.