Initial asset value is the value of an asset at the start of the analysis period. What this represents, exactly, depends on the approach being used to make the calculation. In some cases, the initial value is the value of an asset when first constructed or acquired, while in others, it may be the value at a particular point in time.

This guide describes four basic approaches to calculating initial value. These are as follows:

- Current Replacement Cost – the cost of replacing the asset with its modern equivalent in today’s dollars. This is also referred to as the “gross replacement cost. When this approach is used, the initial value is the cost of constructing or acquiring a new asset. The cost is then adjusted for depreciation to obtain a “depreciated replacement cost” a described further in subsequent chapters. This approach is consistent with the cost perspective described in Section 2.

- Historic Cost – the actual cost paid to first construct or acquire the asset, expressed in year of expenditure dollars. When this approach is used, the initial value is the historic cost constructing or acquiring the asset. This approach is consistent with the cost perspective described in Section 2.

- Market Value – the price of an asset if offered for sale in a competitive market. This value can be established only if such a market exists. In this approach, the initial value is the price of an asset at a specific point in time. Further adjustment to this price may be required to account for recent appreciation or depreciation. This approach is consistent with the market perspective described in Section 2.

- Economic Value – the present value of the benefits of an asset to the asset’s owner, and asset users. When this approach is used, the initial value is the sum of future benefits of the asset at a specific point in time. Costs and benefits over time are discounted to a present value when they are combined. This approach is consistent with the economic perspective described in Section 2.

Table 4-1 summarizes the strengths and weaknesses of each approach.

Table 4-1. Approaches for Establishing Initial Value

| Approach | Description | Strengths | Weaknesses |

|---|---|---|---|

| Current Replacement Cost | Cost of replacing or reconstructing the asset in today’s dollars |

|

|

| Historic Cost | Cost originally paid to construct or purchase the asset |

|

|

| Market Value | Price of the asset in a competitive market |

|

|

| Economic Value | Present worth of future benefits to asset users (or a comparable proxy value) |

|

|

Replacement Cost

The replacement cost of an asset in today’s dollars represents the value of an asset from the perspective of the asset manager charged with deciding which assets to repair, rehabilitate, or replace using today’s dollars. Not surprisingly, many U.S. agencies base their estimate of asset value on asset replacement cost in their initial TAMP, and much of the U.S. and international guidance on calculating asset value to support TAM describes this approach.

Historic Cost

This approach differs from the replacement cost approach in its treatment of inflation. When using historic cost, one obtains the actual cost incurred to purchase or construct the asset in the year-of-expenditure dollars. This value is almost always less than the current replacement cost, or the cost of replacing the asset in today’s dollars, because the current replacement cost reflects the inflation that has occurred since the asset’s construction.

The historic cost is consistent with the U.S. GAAP and U.S. agencies’ calculations of asset value for financial reporting. However, historic costs have limited use for supporting decisions about how to spend today’s dollars. Further, it is frequently difficult to obtain historic cost data for individual assets or asset components, especially for older assets.

Market Value

Where a market exists for an asset, using the market value can simplify the process of calculating both initial value and depreciation, because both aspects are reflected in the market price. A market price also encapsulates the cost of the asset from the owner’s perspective and the economic benefits of the asset from the user’s perspective, helping to integrate the different perspectives concerning what asset value represents. Using the market price to establish fair value is consistent with the international accounting standard IFRS 13.

Economic Value

The economic value can be calculated explicitly as the net present value (NPV) of future benefits or approximated via a utility function that represents these benefits. Calculating the economic value of an asset is consistent with the concepts of benefit-cost analysis and offers the best support for certain types of decisions, like determining which assets to prioritize for resilience investment, retention, or new construction. However, this is the most time-consuming and data-intensive approach of the four listed here. For supporting day-to-day decisions regarding how to maintain existing assets, the additional information the economic value yields may be of limited use.

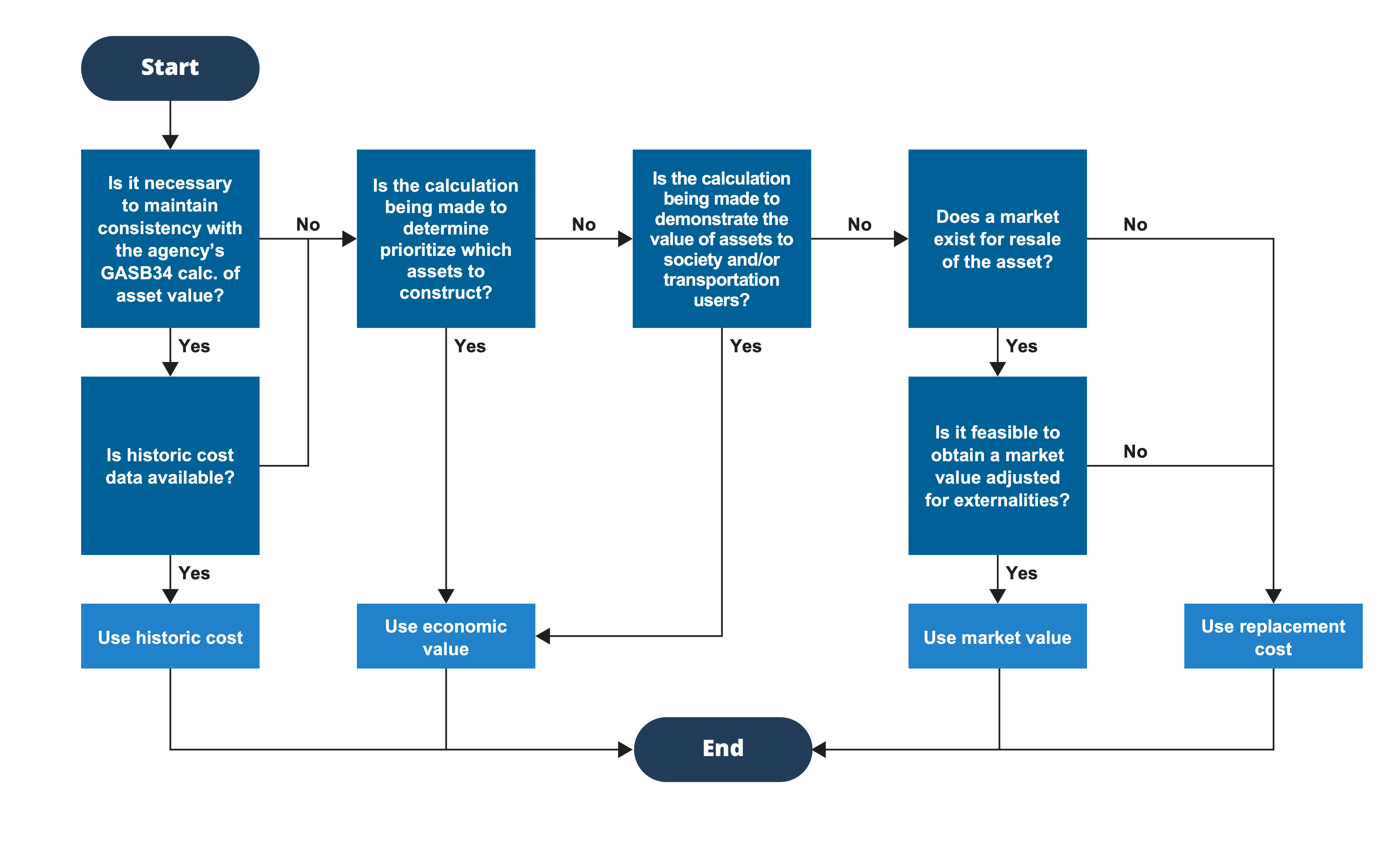

Figure 4-1 is a flowchart to assist in the selection of an approach for calculating initial asset value. The chart recommends current replacement cost as the default approach for establishing initial asset value, while presenting the cases where one of the other approaches may be preferred. The basic factors and assumptions reflected in the flowchart are as follows:

- Historic cost is not recommended for establishing initial value but should be used in cases where an agency seeks to maintain consistency with its calculation of asset value performed for financial reporting using GASB 34.

- Economic value is recommended for certain, specific applications, such as when the asset manager seeks to calculate the overall value of the asset to society in order to establish if an asset is worth constructing or decommissioning. For these cases, simply knowing the cost of an asset is insufficient for determining whether it is worthy of investment.

- In the situations where the market value of the asset is available, it should be used over the current replacement cost. When market value is not available, current replacement cost should be used.

This section describes how to calculate initial asset value using each of the four methods described previously: current replacement cost; historic cost; market value; and economic value. The following subsections discuss issues specific to each approach and provide step-by-step guidance. This guidance should be applied for calculating value for each asset class and component identified previously as described in Chapter 3. Since economic value differs significantly from the other three approaches and is recommended only for specific applications, details of this approach are provided in Appendix 4.A.

Overview

Calculating the current replacement cost of an asset may seem to be a straightforward exercise, and generally speaking it is. One must establish a unit cost for construction of a new asset, determine the quantity of the asset, and multiply the cost by the quantity. However, at each step of the way there are possible complications that one must consider. These include:

- Determining the units of measure for an asset. This requires considering what factors drive the cost. For instance, for pavements and bridges costs are generally proportional to area (lane miles of pavement or square feet of deck). For other assets costs may be expected to vary based on system length or other variables.

- Establishing the number of different asset groups. That is, how many different unit costs need to be determined? At a minimum, there should be at least one unit cost per asset component established as described in Chapter 3. In many cases, there may be different costs established by material (steel versus concrete bridges) or functional system (Interstates versus minor arterials).

- Adjusting historic data for inflation. Often an analysis is performed of actual, historic costs to determine the current replacement cost. Where such an analysis is performed historic costs must be inflated to today’s dollars.

- Deciding when an asset would need to be replaced by its modern equivalent. In some cases, it may not be practical or desirable to replace an asset in kind, such as in cases where an asset is based on obsolete technology. It is important to consider where this might be the case, and in these cases establish the cost of replacing an asset with its modern equivalent.

While it is possible to calculate a specific cost for each individual asset in an inventory, as a practical matter, agencies’ asset inventories are often too large to justify the expense of preparing detailed cost estimates for each individual asset. To support TAM applications, agencies need to establish unit costs to use for estimating the cost of asset replacement.

Calculation Steps

The basic steps involved in calculating current replacement cost using unit costs are shown in the following table. These steps should be followed for each asset class and component being included in the calculations.

- Step 1 – Determine Units of Measure:

Analyze the data to determine the correct units of measure to use for each asset class and component for the purpose of estimating replacement costs. Typically, costs are estimated based on area (e.g., for pavement and bridges), length (e.g., for guideway) or asset count (e.g., for vehicles).

- Step 2 – Collect Data on Replacement Costs:

Collect data on the cost of replacing each asset class and component defined as described in Chapter 3. The data may include historic asset construction costs and/or cost estimates for planned projects, as well as data on units of measure established in Step 1. Where data are unavailable, it may be possible to obtain data from an agency’s peers.

- Step 3 – Adjust Costs for Inflation:

Adjust the costs obtained in Step 1 to represent costs in today’s dollars. This will typically require inflating historic costs and may require deflating any predicted future costs. Appendix 4.B discusses the treatment of inflation.

- Step 4 – Determine How to Group Assets:

As necessary, create different groups for asset classes or components to reflect differences in replacement costs. Asset characteristics such as roadway classification, rural or urban setting, regional factors, and asset materials may impact replacement costs.

- Step 5 – Calculate Unit Costs for Each Group:

Using the data for each asset group, take the sum of the construction costs and divide by the total area, length, or count (depending on the asset type).

- Step 6 – Apply Unit Costs:

The last step is to multiply the unit costs established in Step 5 by the quantity of each asset or asset component to determine the current replacement cost.

Overview

The primary motivation for establishing initial value based on historic cost is to maintain consistency with an agency’s financial reporting. Requirements for U.S. agencies to use for preparing financial reports are described in GASB Statement 34 (1). This document describes that:

Capital assets should be reported at historical cost. The cost of a capital asset should include capitalized interest and ancillary charges necessary to place the asset into its intended location and condition for use. Ancillary charges include costs that are directly attributable to asset acquisition—such as freight and transportation charges, site preparation costs, and professional fees…

In principle, determining the historic cost of an asset should require nothing more or less than reviewing an agency’s financial records to determine the cost paid to first construct or acquire the asset. Where sufficient data are available to support this approach, one should determine the cost of construction or acquisition, as well of capitalized interest and ancillary charges as described above.

The fundamental challenge with this approach is that records on historic costs may not be readily available, and where they are available may not provide a sufficient level of detail for establishing the cost by asset class or component. For instance, one might have a single cost from the time a highway corridor was first constructed – but without details on the amount paid per section of pavement or per bridge, let alone for assets such as signs, signals, culverts, guardrails and other assets – some of which may have been completely replaced since the corridor was constructed. The challenge is compounded by the fact that many transportation assets are long-lived, so one may need to review extensive historic data to establish the costs for a given asset.

Many agencies have faced this challenge in calculating historic costs since GASB Statement 34 was first published in 1999. A basic strategy for overcoming it is to estimate replacement costs by asset class using unit costs expressed in today’s dollars, then deflate the estimated cost back to year-of-expenditure dollars using information on asset age. This approach is termed the “Wooster Method” as its use was first documented in a financial report for the Town of Wooster, Ohio (6).

Calculation Steps

The following are the basic steps involved calculating initial asset value using historic costs with this approach:

- Step 1 – Collect Data on Asset Age:

Collect data on asset age for the assets and asset components established as described in Chapter 3. If the age of specific assets is unavailable, then the age distribution of the inventory may be used as an alternative.

- Step 2 – Calculate Current Replacement Cost:

Follow the steps in the previous section to calculate current replacement cost for each asset class and component.

- Step 3 – Deflate the Current Replacement Cost:

Deflate the current replacement cost based on the asset age data collected in Step 1 to obtain estimated historic costs. Appendix 4.B discusses the treatment of inflation.

Overview

Where a competitive market exists for an asset, it may be feasible to establish the asset’s market value. This market value represents the current value of the asset. Unlike the current replacement cost and historic cost approaches, this value incorporates accumulated depreciation since the asset was first constructed or acquired.

Because many transportation assets are fixed in place, it is the exception rather than the rule that a market value may be determined. In most cases it is not terribly practical to transfer a transportation asset from one owner to another. There are two primary exceptions to this rule. One is the case of vehicles and equipment that can be easily transferred, and the second is the case where a market value is established for the purpose of privatizing infrastructure, such as to issue a concession to a private entity to operate and maintain a toll road. These two cases are described below.

Vehicles and Equipment

In many cases it is possible to perform an independent fair market value assessment for vehicles and equipment, as these assets are readily transferrable from one owner to another. Where a market value can be established, this value indicates what the market is willing and able to pay for a specific vehicle or piece of equipment, taking into consideration prior use, current condition, remaining useful life, and other factors. In some cases, a vehicle or piece of equipment may have significant remaining value even once it is replaced by an agency. However, older or damaged assets may have a remaining value equal to their scrap or disposal value.

Used vehicle fleets are often valued and sold via a broker, auction houses, or other third-party tools. In some cases, fleets are sold to other agencies. Where such an approach is used, a market value is determined for the fleet, which can be equated to a value per vehicle.

For non-revenue vehicles and pieces of equipment, it is more common for any transactions to occur through private party transactions or auctions. In these cases, an independent fair market value assessment of the asset is often performed, such as through referencing guides such as the Kelley Blue Book for used vehicles (30), and other industry guides.

Privatized Infrastructure

When evaluating opportunities for privatizing transportation infrastructure, investors typically classify the different opportunities as either “green field” or “brown field” investments. In this context, a “green field” investment is one in which a new facility is constructed where none previously existed – e.g., a new toll road or transit system. By contrast, a “brown field” investment is one where an asset that is already operational is transferred to private control in exchange for some price. Such “brown field” investments, where they occur or are evaluated, provide an opportunity for establishing the market value of transportation assets.

Investors evaluating a brown field investment consider a variety of different risks and factors, also termed “key value drivers.” Once they have identified these drivers, investors will perform forecasts and financial analyses on the key value drivers to determine the market value of a given investment.

Below is an example of the key value drivers for a toll road concession.

- Asset Type: different toll road asset types present a different set of risks to an investor that is valuing a brown field toll road. For instance, a highway system or large network of toll roads that connects major population centers may have more diversified traffic types, routes, and asset maturity. As a result, they are often resilient to fluctuations in economic conditions. By contrast, a standalone road in a rural area may be more speculative in terms of revenue generation. Brown field asset valuations benefit from a demonstrated history of traffic that allow an investor to compare the actual level of traffic vs. original forecasts.

- Remaining Concession Term: in a toll road concession structure, investors will consider the remaining term of the concession with a public sponsor, as the term length is a significant driver of the length of time that an investor can generate cash flow. Term of the concession refers to the length of a contract between a developer and a public sponsor to design, build, finance, operate, and maintain a toll asset (usually anywhere from 30 to 99 years). In a brown field valuation, the asset has already been designed, built, and originally financed. When an original concessionaire sells its stake in a toll road, the concession term typically remains static. Thus, the ability to generate cash over the remaining concession term will directly impact the price that an investor is willing to pay for an asset. In general, the longer the concession term, the higher the price that an investor would be willing to pay for the asset, as the investor has a longer period of time available to generate a return on investment. Further, longer concession terms may provide opportunities for investors to issue additional debt to further leverage the asset, which will ultimately increase the asset’s value. The economic life of properly maintained toll roads should outlast the concession term.

- Counterparty Risks: in certain toll road structures, investors will have to consider the ability for a counterparty to make timely and ongoing payments throughout the term of the project. An availability payment structure requires the public sponsor to make a long-term commitment to provide annual payments for the operation and maintenance of a project, subject to certain “availability” performance standards. By contrast, a revenue risk toll concession requires the concessionaire to assume the risks of revenue generation. Investors purchasing a toll road asset under an availability payment structure will consider the public sponsor’s ability to make payments to the concessionaire, as well as the performance payment regime.

- Revenue Considerations: assessing revenue considerations is one of the most important factors of valuing a toll road. Investors will primarily consider two overarching aspects with respect to the ability to generate revenue for a toll road: (1) the volume of traffic, and the (2) ability to raise toll rates. Uncertainty surrounding the ability to generate certain traffic levels and/or raise toll rates over time contributes to investor’s view of risk when valuing a toll road asset. Investors valuing a brown field toll road asset will consider both aspects with the benefit of a demonstrated history of traffic, which will reduce risk surrounding the forecasting of future revenue compared to a green field valuation with no operating history.

- Operating Cost Considerations: when valuing operating costs for a toll road, investors may consider the age of the road and associated equipment, its geographic location and typical weather conditions, terrain, and toll collection approach. Deferring ongoing maintenance may shorten the asset’s life and investors will consider the level of future funding that is needed to ensure proper road preservation. Also important is the concessionaire’s contractual structure for handling operations and routine maintenance. Under a concession structure, the concessionaire may outsource the operations and maintenance of the toll road to a third-party who specializes in providing these services. Investors will consider both the actual level of operation and maintenance costs from the history of operating the asset as well as the operating and maintenance regime.

- Renewal Costs Considerations: investors will seek to understand the expected economic life of the toll road asset, and the level, if any, of additional capital improvement funding that is needed to be made to ensure the asset is maintained to proper standard. These capital improvements would ideally be paid with revenue generated from the asset. If additional funds are needed for capital improvement requirements, investors will consider these additional needs when determining the price paid for the asset and the overall funding mix compared to the remaining term of the concession. Asset conditions will impact the level of future capital improvement needs, operating and maintenance (O&M) costs, ability to generate revenue, and future funding needs.

- Handback Requirements: investors will also consider the handback requirements to the public sponsor at the end of the concession term. Handback requirements typically surround the asset’s return to the public sector in a certain condition (i.e., properly maintained throughout the term of the contract). Asset handback requirements that are not met include financial penalties to the investor.

Investors entering into a concession agreement will consider primary key value drivers, such as those described above, as well as other structuring, legal, and financial considerations to develop projections for the amount of cash flow that the asset will potentially generate over the remaining term of the concession. The price that an investor would be willing to pay is determined based on the expected future level of cash generation. In many cases, there is no terminal value calculated on a concession, as once the concession term has expired, the asset is handed back to the public sector.

To determine cash flow available for equity distributions, investors will develop a forecast of revenue generation from tolling or availability payments and deduct expected future O&M expenses, renewal and rehabilitation costs, taxes, principal and interest on debt, and any other ongoing obligations as part of the cash flow waterfall on an annual basis. Historical results will be highly beneficial to investors for forecasting future needs. The bottom-line amount on an annual basis represents distributions to the equity investors for purchasing the asset, and the expected amount of future distributions will inform investors of the current price they are willing to pay.

The key value driver considerations as discussed above as well as other risks to a project as determined by an investor will determine the discount rate that an investor utilizes to discount future cash flows to a present value to assist in informing the investor of the price that should be paid for the equity ownership in the asset. All else equal, a higher discount rate to future cash flows will result in a lower present value of future cash flows and vice versa. The present value of future cash flows is the basis for an investor’s price for the equity in a project. Investors will determine their optimal capital structure to purchase the equity in a concessionaire.

The capital structure for a concessionaire or investor purchasing a toll road concession will be much different from a public owner and operator of a toll road, given the private sector goal of profit maximization. Investors of toll road asset will maximize earnings by leveraging the asset as much as lenders and structural project features will allow, as additional debt in lieu of equity maximizes financial return on the asset. For instance, investors purchasing a toll concession may purchase the original equity in the concessionaire in the transaction, and in many cases refinance outstanding debt to leverage the asset to the optimal capital funding mix. The example below illustrates the refinancing arrangement for the Chicago Skyway as detailed by FHWA (31).

The Chicago Skyway was purchased by Calumet Concession Partners LLC in 2016. This example demonstrates Canadian pension funds’ appetite for mature U.S. infrastructure assets that have completed construction and have a demonstrated operating history – thus reducing risk to a level commensurate with a pension funds’ appetite. The original capital structure included a combination of equity and debt as shown below. In 2005, the structure was refinanced to include additional debt to leverage the asset. The 2016 sale to Calumet Concession Partners LLC totaled $2.8 billion including the sources of funding provided below. The term of the concession did not change when Calumet purchased the original equity stake in the concessionaire.

Original capital structure: $882 million equity; $948 million bank loan

2005 refinancing: $510 million equity; $961 million capital appreciation bonds; $439 million current interest bonds; $150 million subordinate bank debt

2016 sale: $1.5 billion equity; $1.26 billion bank debt

Implications for Establishing Asset Value

The above discussion has several important implications for the use of the market perspective for valuing transportation assets. These include:

- Where market value can be determined, it incorporates consideration of the cost of an asset, its current condition, and a range of other factors.

- It is often feasible to establish market value for assets that can be readily transferred, such as vehicles and equipment.

- For fixed assets it may be possible to establish a market value for a facility encompassing multiple assets by observing the price established for a proposed or actual privatization concession.

- Where a market value has been established it is specific to a given asset or facility and cannot be readily applied to other assets without accounting for the key value drivers. Examples of these drivers are discussed above for the case of a toll road concession.

- The financing of a transaction is extremely important in the case of large-scale transactions such as toll road concessions. This complicates the process of using the price of such a transaction for asset management applications where details concerning how work is financed are largely immaterial.

Calculation Steps

The process for applying the market perspective to asset valuation is summarized below.

- Step 1 – Establish Whether a Competitive Market Exists:

Evaluate whether a market exists for a given asset or group of assets. A market is likely to exist in cases where the asset can be readily transferred between owners, such as for vehicles and equipment. A market may exist if a private concession has been proposed or implemented. The market can be competitive if there are multiple potential buyers and/or multiple sellers in the market.

- Step 2 – Identify Applicable Assets:

Specify the specific assets for which a market price can be established. In the case where value is established through the price of a private concession, the price may be specific to a small group of assets – e.g., the pavement and bridges that are part of a toll facility.

- Step 3 – Adjust the Market Price for Inflation:

If the market price is not current, it should be adjusted for inflation. See Appendix 4.B for a discussion of the treatment of inflation. Once the market price has been adjusted, it represents the current value for the selected assets.

- Step 4 – Value Other Assets Using the Replacement Cost Method:

Where market price can be calculated for only a subset of the assets being included in a calculation, the initial value for other assets should be calculated using the current replacement cost approach.

Overview

The economic perspective differs significantly from the cost and market perspectives due to the way it compares the value of an improvement to a baseline. With the other perspectives baseline values are established, but with the economic perspective the baseline is not a starting point for future valuation via treatments or depreciation. Instead, the baseline is compared to the improvement value, or the total net incremental value to the public brought about by building a given asset or facility relative to not doing so. Depreciation and the impact of treatments are inherently included within the user and externality values. Furthermore, unlike the case of the other perspectives, the economic perspective incorporates both user and non-user impacts, positive and negative.

With the economic perspective, historic data on the use and economic value of an asset mark trends for the current economic value. With this perspective, the current asset is presented as the baseline, and any changes to the asset – such as maintenance, realignment, or decommission – are given value relative to the benefits and costs they provide to the public. In the cases of roadway construction or decommission, an asset’s value is assessed by comparing the total future opportunities an asset generates with the opportunities created by alternative land uses.

Establishing Value

Although the methods for obtaining the benefits and costs can be complicated, the outcome is simple. If the public experiences a net gain in value due to the roadway investments, then these investments are worthwhile. While economic theory provides a reasonable methodology for assessing the net value of these investments, the challenge is determining how the public values changes to roadways or other transportation assets.

Members of the public do not value a transportation asset equally, nor do they prioritize the same value categories. The size and geographical range of the impacted community is unique for each asset. As the significance of the transportation system increases the impacted range also increases. For example, the people and businesses who gain from changes to an interstate freeway – both current and potential future users – could live in the same city or they could live a thousand miles away from each other. Meanwhile, only the residences located close to the freeway will experience firsthand the negative impacts of noise and emissions, especially if those externalities lower property values.

Establishing the value for improvements to a transportation asset begins with recognizing its role in people’s lives and business activities. Transportation assets allow people and goods to travel faster, safer, and more conveniently. They enhance route options via improved network connectivity and create new links to destinations previously inaccessible or at least for which access was cost prohibitive. Bridges, especially major ones, are special cases because they significantly enhance connectivity and overcome physical transportation barriers. Highways also create a secondary benefit by establishing public right-of-way that allows utilities (e.g., energy, water, and communications), to expand connectivity and capacity for communities.

An asset’s total economic value accounts for all uses and location characteristics that could positively or negatively impact people and businesses. The scale of benefits is determined by the volume of vehicular travel in the case of highways and person travel for transit. This volume is relatively easy to estimate from traffic counts. Building upon the traffic counts, sophisticated models, such as travel demand models, predict how physical changes to a facility or network impact travel characteristics such as volume, frequency, vehicle occupancy, and trip scheduling.

Principles of Economic Valuation

Several important principles are applied in all economic valuations. First, it is important to identify the potential effects of a project attributable to its costs. A clear definition of the impacts from the project is crucial for correctly estimating the benefits. This serves to avoid double counting the project’s benefits and disbenefits. Another principle of economic valuations is to compute the present value of future costs and benefits, enabling comparisons with a common basis of understanding. The discount rate, which brings future values into present value, can have a non-trivial influence on the analysis of different projects, depending on the timing and magnitudes of the project impacts. As a result, the selection of the discount rate becomes an important policy decision and consideration for sensitivity analyses. These and other issues are discussed more fully in Appendix 4.A.

Comparative Contexts for Asset Management

Asset management assessments differ from capital projects involving new construction, but still require a comparison to reveal their value. Asset value may need to be calculated in several different contexts including:

- Maintenance activities for one or more assets

- Physical changes to a particular asset that could impact its future uses

- System-wide assessments for an entire class of transportation assets (e.g., Interstate).

Maintenance Activities. An economic measure of value can assess the difference in value obtained by users at different levels of service for roadway surfaces or safety features. The user value is measured by comparing an enhanced level of maintenance against the current conditions. Principal measures of user value are travel speeds and vehicle operating and maintenance costs, which increase with poor road quality. There is an extensive collection of literature studying the impacts of road quality on users (32). However, in practice, the incremental economic value of improved maintenance is relatively low compared to the value measured via the cost approach.

Physical Changes. This second case is the most common form of economic analysis since it involves an evaluation of physical changes to an asset that affect its use. Changes include user-oriented improvements such as capacity (e.g., widening, overpasses, and truck lanes), operational improvements (e.g., interchange improvements, shoulders, and auxiliary lanes), and access (e.g., decommissioning, one-way streets, ramps) that aim to alleviate congestion, improve safety, or serve other agency goals. Economic valuations of such physical changes rely on forecasted changes in traffic patterns compared to a baseline that accounts for future uses under the current design. The value of these physical changes is estimated by differences in benefit categories (e.g., time savings, operating costs) over the life of the projects.

System-Wide Assessments. The value of an asset can be evaluated from a system-wide perspective by examining the next best alternative road class. However, this is usually a contrived exercise, and offers limited benefit outside of the theoretical. Consider the value of a state’s major arterial facilities. From an aggregated asset perspective, the next best option would be the minor arterials. Each type of roadway has a common set of characteristics, including average travel speeds per mile, intersection crossings and signals, and potential levels of normal traffic congestion. In this hypothetical case, the value of the major arterial is derived from the differences in value categories between the major and minor arterials. Since major arterials permit faster speeds, their value is expected to be higher, provided that the value of this reduced travel is not overcome by potentially increased travel cost or crash risk. This same approach could be applied for other roadway classes too. The use of local neighborhood roads in a car can be compared with an option to ride a bike or walk to a destination. These with- or without- asset evaluations require data on the use of a facility as well as data on opportunities created by eliminated vehicle use.

Calculation Steps

The process for applying the economic perspective to asset valuation is summarized below.

- Step 1 – Define the Assessment Scope:

Establish the set of assets to be analyzed. Define the with- and without-project contexts. Demarcate the breadth of the analysis geographically and temporally.

- Step 2 – Identify Potential Impacts:

Select the variables, or categories of impact, which will have an impact on the user and non-user benefits and disbenefits. Consider the characteristics of the asset, its users, and the community surrounding it. Options include travel time, vehicle operating costs, safety, pollution, asset maintenance, and wider community impacts, among others.

- Step 3 – Evaluate and Collect the Data:

Assess the data necessary to measure the potential impacts. Understand the trade-offs between stronger data collection and collection costs. For the chosen datasets, convert the impact categories into impact factors and impact value per unit.

- Step 4 – Project System Use:

Use current and historic traffic or passenger counts to understand the trends in the volume of vehicles and passengers. Predict the use of the system with and without investment, such as through use of a travel demand model.

- Step 5 – Calculate the Economic Value:

Using the output of the demand models and the impact data, weigh the benefits and costs of the with- and without-project contexts. Monetize impacts and apply a discount rate to bring benefits and costs into present value, and, if assessing a large transportation asset, account for the residual value at the end of the time period. Compare the two project scenarios to understand the value of the proposed changes.

The following are hypothetical examples illustrating application of the steps described in Section 4.2.

For pavement an agency decides to base its calculation of initial asset value on reconstruction cost using pavement lane miles as the unit of measure. Table 4-2 shows the data obtained to compute a unit cost for pavement in millions of dollars per lane mile for a given subtype and network. The table lists data for a set of pavement reconstruction projects. For each it shows the project year, quantity of pavement reconstructed in lane miles, project cost in year of expenditure dollars, and project cost in 2020 dollars. Project costs were inflated to 2020 costs using the Engineering News Record (ENR) Construction Cost Index.

Table 4-2. Example Data for Past Pavement Reconstruction Projects

| Project | Year | Description | Cost - Year of Expenditure ($M) | Cost - 2020 ($M) | Lane Miles (LM) | Unit Cost (2020 $M/LM) |

|---|---|---|---|---|---|---|

| 1 | 2010 | Route 80 MP 1.9 | 52.6 | 68.5 | 24.0 | 2.9 |

| 2 | 2016 | Route 84 MP 0.6 | 13.5 | 15.0 | 3.6 | 4.2 |

| 3 | 2007 | Route 92 MP 2.6 | 27.0 | 38.9 | 10.2 | 3.8 |

| 4 | 2011 | Route 101 MP 4.7 | 35.6 | 45.0 | 6.3 | 7.1 |

| 5 | 2005 | Route 101 MP 7.1 | 180.0 | 277.2 | 32.0 | 8.7 |

| 6 | 2014 | Route 104 MP 18.6 | 25.7 | 30.1 | 4.2 | 7.2 |

| 7 | 2009 | Route 104 MP 19.9 | 12.0 | 16.1 | 1.8 | 8.9 |

| 8 | 2017 | Route 680 MP 5 | 42.1 | 45.0 | 19.6 | 2.3 |

| 9 | 2013 | Route 680 MP 12 | 28.3 | 34.0 | 8.0 | 4.3 |

| 10 | 2018 | Route 780 MP 15.5 | 28.0 | 29.0 | 9.2 | 3.2 |

| Total | 598.8 | 118.9 | 5.0 |

The result is a unit cost of $5.0 million per lane mile. However, in reality there is a significant difference in costs between the different projects, with most projects in the range of $2 to $4 million and a small number of more expensive projects. This may suggest a need to group pavements by system or surface type to better account for this variability.

An agency decides that to maintain consistency with its financial reporting, the agency should use historic costs rather than current replacement cost. However, historic cost data are not consistently available. Thus, the agency decides to use the Wooster Method to estimate historic costs. Table 4-3 shows the application of this method for a selected set of assets using unit cost of $5 million per lane mile (as obtained in Example 4-1). The unit cost developed as described in Example 4-1 is applied and deflated to estimate historic costs. In this hypothetical example the total replacement cost is $3.9 billion in constant 2020 dollars and $2.0 billion in year of expenditure (historic) dollars.

Table 4-3. Estimation of Historic Costs of Pavement Reconstruction

| Route | Lane Miles (LM) | Year Constructed | 2020 Cost ($M) | Historic Cost ($M) |

|---|---|---|---|---|

| 11 | 96 | 2001 | 480.0 | 265.5 |

| 11 | 128 | 2004 | 640.0 | 397.1 |

| 22 | 72 | 1989 | 360.0 | 144.9 |

| 22 | 192 | 1996 | 960.0 | 470.5 |

| 33 | 32 | 2000 | 160.0 | 86.8 |

| 44 | 44 | 2003 | 220.0 | 128.4 |

| 44 | 8 | 1997 | 40.0 | 20.3 |

| 55 | 128 | 1990 | 640.0 | 264.1 |

| 66 | 28 | 2001 | 140.0 | 77.4 |

| 77 | 52 | 1999 | 260.0 | 137.4 |

| Total | 3,900.0 | 1,992.7 |

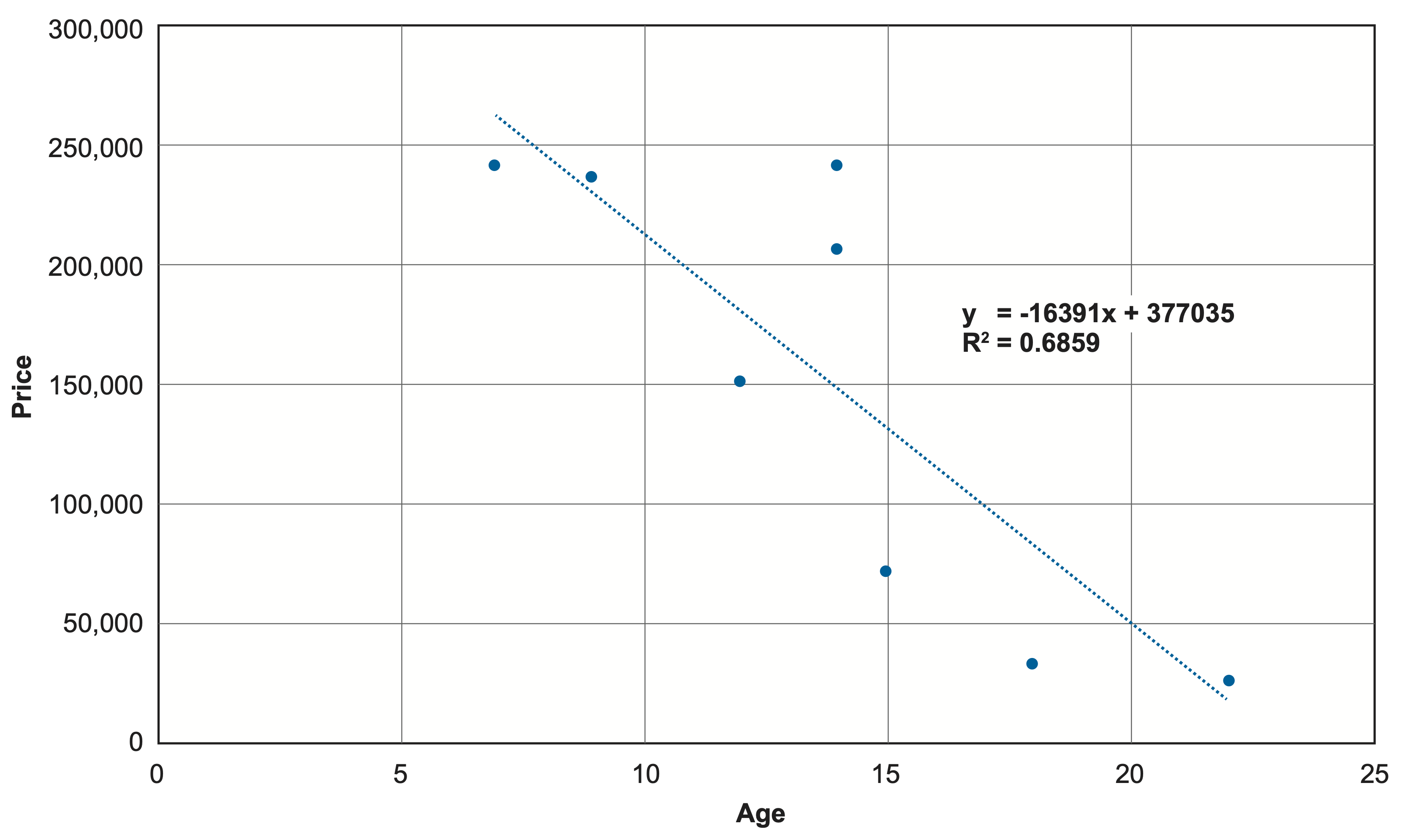

A transit agency has a fleet of over-the road transit buses purchased at different times from the same manufacturer. The agency seeks to establish the value of these buses using market value. Table 4-4 is a list of used coach buses from a selected manufacturer available for sale from an online bus reseller. It shows the age, mileage and price of each bus offered for sale.

Table 4-4. Over-the-Road Coach Buses Available for a Selected Manufacturer and Reseller

| Bus | Age (years) | Mileage | Prices ($) |

|---|---|---|---|

| 1 | 7 | 650,000 | 239,900 |

| 2 | 9 | 181,000 | 234,900 |

| 3 | 12 | 288,000 | 149,900 |

| 4 | 14 | 305,000 | 204,900 |

| 5 | 14 | 399,899 | 239,900 |

| 6 | 15 | 350,000 | 69,900 |

| 7 | 18 | 550,567 | 32,500 |

| 8 | 22 | not listed | 25,000 |

The agency uses the data in the table to construct a simple linear model for predicting the price of a used bus. In this case, price is predicted as a function of age using the following relationship:

Price = 377,035 - 16,391 * Age

Figure 4-2 shows the resulting model.

Note that alternative models were tested including both mileage and age, and substituting mileage for age. In this case the age-based model provides the best fit. In practice price may depend on a number of age, mileage, and other variables.

An agency is interested in using asset value to help prioritize reconstruction of a set of bridges to improve resilience. After discussing the cost, market and economic perspectives on asset value, agency leadership determines that the economic perspective is needed for this application. This perspective can help compare the benefits to society of reconstructing different bridges. Agency staff adapt the bridge screening approach established in FHWA’s National Bridge Investment Analysis System (NBIAS) to estimate asset value (32).

The approach used by NBIAS is to calculate the benefit of a bridge as the savings in travel and operating costs relative to that which would be incurred if all vehicles were detoured around the bridge. The calculation is made for autos and truck, and summed over time, applying a discount rate. The approach utilizes data available for U.S. highway bridges in the National Bridge Inventory (NBI) along with a small number of additional parameters. The following equations detail the calculation:

\begin{align*} B_a &= 365.25*T [ \frac{\tau}{100}(L C_l^t + \frac{L}{v_d} C_h^t) + (\frac{100-\tau}{100})(L C_l^t + \frac{L}{v_d} C_h^c)] \\ B &= B_a \sum_{i=1}^{N} \delta^{(i-1)} \end{align*}

where:

This section provides examples of “emerging,” “strengthening,” and “advanced” practices with respect to calculation of initial asset value. Maturity levels are defined for each of the four approaches defined in the guidance. In the table an emerging practice is one that supports the guidance with minimal complexity, an advanced practice illustrates a “state of the art” example in which an agency has addressed some aspect of the asset value calculation in a comprehensive manner, and strengthening practice lies between these two levels.

Unit replacement costs are established by asset class/component using expert judgement and/or industry defaults.

Unit replacement costs are established through a one-time analysis of project data and updated in subsequent years based on inflation.

Unit replacement costs are established through a well-documented process that includes: analysis of project data; assessment of how assets should be grouped for analysis (e.g., by system, material and/or surface type); and a defined update cycle (e.g., once every 1 to 2 years).

Neither historic costs nor asset age can be reliably obtained at an asset level. Overall expenditures by work type and system are used as the basis for calculating asset value without relating expenditures to specific assets.

An asset inventory is available detailing asset age. Historic costs are not reliably tracked by asset but can be estimated using unit replacement costs and asset age

Actual costs of construction/asset purchases are tracked by asset.

Market value is estimated based on expert judgement and/or industry defaults.

Market value is established through a one-time analysis of asset resale or other data and updated in subsequent years based on inflation.

Market value is established through a well-documented process that includes: analysis of asset resale or other data; assessment of how assets should be grouped for analysis (e.g., by system, material and/or surface type); and a defined update cycle (e.g., once every 1 to 2 years).

Calculations of economic value rely on estimates of detour distance and speed to estimate changes in user costs from addition or removal of an asset, but do not attempt to quantify the impact of changes in travel demand.

Calculations of economic value rely on estimates of detour distance and speed to calculate changes in user costs from addition or removal of an asset. The elasticity of travel demand is used to estimate changes in traffic volumes.

Calculations of economic value utilize travel demand models to quantify impacts of potential changes to the network from addition or removal of an asset.