Calculating initial value is addressed in Chapter 4. For more detailed information, please refer to the chapter.

If so, use historic cost.

If so, use economic value.

If so, use market value.

If so, use current replacement cost.

The cost of replacing the asset with its modern equivalent in today’s dollars.

- Step 1 – Determine Units of Measure:

Analyze the data to determine the correct units of measure to use for each asset class and component for the purpose of estimating replacement costs. Typically, costs are estimated based on area (e.g., for pavement and bridges), length (e.g., for guideway) or asset count (e.g., for vehicles).

- Step 2 – Collect Data on Replacement Costs:

Collect data on the cost of replacing each asset class and component defined as described in Chapter 3. The data may include historic asset construction costs and/or cost estimates for planned projects, as well as data on units of measure established in Step 1. Where data are unavailable, it may be possible to obtain data from an agency’s peers.

- Step 3 – Adjust Costs for Inflation:

Adjust the costs obtained in Step 1 to represent costs in today’s dollars. This will typically require inflating historic costs and may require deflating any predicted future costs. Appendix 4.B discusses the treatment of inflation.

- Step 4 – Determine How to Group Assets:

As necessary, create different groups for asset classes or components to reflect differences in replacement costs. Asset characteristics such as roadway classification, rural or urban setting, regional factors, and asset materials may impact replacement costs.

- Step 5 – Calculate Unit Costs for Each Group:

Using the data for each asset group, take the sum of the construction costs and divide by the total area, length, or count (depending on the asset type).

- Step 6 – Apply Unit Costs:

The last step is to multiply the unit costs established in Step 5 by the quantity of each asset or asset component to determine the current replacement cost.

For pavement an agency decides to base its calculation of initial asset value on reconstruction cost using pavement lane miles as the unit of measure. Table 4-2 shows the data obtained to compute a unit cost for pavement in millions of dollars per lane mile for a given subtype and network. The table lists data for a set of pavement reconstruction projects. For each it shows the project year, quantity of pavement reconstructed in lane miles, project cost in year of expenditure dollars, and project cost in 2020 dollars. Project costs were inflated to 2020 costs using the Engineering News Record (ENR) Construction Cost Index.

Table 4-2. Example Data for Past Pavement Reconstruction Projects

| Project | Year | Description | Cost - Year of Expenditure ($M) | Cost - 2020 ($M) | Lane Miles (LM) | Unit Cost (2020 $M/LM) |

|---|---|---|---|---|---|---|

| 1 | 2010 | Route 80 MP 1.9 | 52.6 | 68.5 | 24.0 | 2.9 |

| 2 | 2016 | Route 84 MP 0.6 | 13.5 | 15.0 | 3.6 | 4.2 |

| 3 | 2007 | Route 92 MP 2.6 | 27.0 | 38.9 | 10.2 | 3.8 |

| 4 | 2011 | Route 101 MP 4.7 | 35.6 | 45.0 | 6.3 | 7.1 |

| 5 | 2005 | Route 101 MP 7.1 | 180.0 | 277.2 | 32.0 | 8.7 |

| 6 | 2014 | Route 104 MP 18.6 | 25.7 | 30.1 | 4.2 | 7.2 |

| 7 | 2009 | Route 104 MP 19.9 | 12.0 | 16.1 | 1.8 | 8.9 |

| 8 | 2017 | Route 680 MP 5 | 42.1 | 45.0 | 19.6 | 2.3 |

| 9 | 2013 | Route 680 MP 12 | 28.3 | 34.0 | 8.0 | 4.3 |

| 10 | 2018 | Route 780 MP 15.5 | 28.0 | 29.0 | 9.2 | 3.2 |

| Total | 598.8 | 118.9 | 5.0 |

The result is a unit cost of $5.0 million per lane mile. However, in reality there is a significant difference in costs between the different projects, with most projects in the range of $2 to $4 million and a small number of more expensive projects. This may suggest a need to group pavements by system or surface type to better account for this variability.

Unit replacement costs are established by asset class/component using expert judgement and/or industry defaults.

Unit replacement costs are established through a one-time analysis of project data and updated in subsequent years based on inflation.

Unit replacement costs are established through a well-documented process that includes: analysis of project data; assessment of how assets should be grouped for analysis (e.g., by system, material and/or surface type); and a defined update cycle (e.g., once every 1 to 2 years).

Asset purchase or construction and reconstruction are included in the asset value calculations. Supplemental analysis is not performed to consider inclusion of other treatments.

An analysis is performed to determine what treatments to include in the analysis, and what treatments are assumed to occur based on the agency’s life cycle strategy. The analysis is conducted separately from establishing asset life cycle strategies.

An analysis is performed to determine what treatments to include in the analysis, and what treatments are assumed to occur based on the agency’s life cycle strategy. The analysis is conducted as part of the development of asset life cycle strategies and/or strategies are updated as appropriate following the analysis.

Asset age is not well established. Costs by asset class are calculated by year and depreciated without associating costs to specific assets.

Asset or component age is known or can be estimated based on inventory and treatment data, supporting calculation of depreciation at an asset class, asset and/or component level.

Asset age or component age is known or can be estimated based on inventory and treatment data. An analysis is performed of the consumption of asset benefits. A custom pattern of benefit consumption is used if supported by the analysis. Depreciation is calculated based on the selected approach by asset class, asset and/or component.

Asset value is calculated for major assets at an aggregate level as required to support financial reporting and TAMP requirements.

Asset value is calculated for major assets. Either the calculations are performed at an asset/component level or supplemental analysis is performed to confirm use of the approach for aggregating asset value calculations.

Asset value is calculated for major assets. Either the calculations are performed at an asset/component level or supplemental analysis is performed to confirm use of the approach for aggregating asset value calculations. Sensitivity analyses are periodically conducted to show the effect of changes in key analysis parameters.

Asset value is reported in agency documents, including financial reports and the agency’s TAMP, but approaches used in different documents may be inconsistent.

Asset value is reported in agency documents, including financial reports and the agency’s TAMP. Discrepancies between different estimates are documented.

Asset value is reported in a consistent manner in different agency documents, including financial reports and the agency’s TAMP. Multiple approaches for reporting value are used as needed to maintain consistency between documents while satisfying reporting requirements.

The actual cost paid to first construct or acquire the asset in year of expenditure dollars.

- Step 1 – Collect Data on Asset Age:

Collect data on asset age for the assets and asset components established as described in Chapter 3. If the age of specific assets is unavailable, then the age distribution of the inventory may be used as an alternative.

- Step 2 – Calculate Current Replacement Cost:

Follow the steps in the previous section to calculate current replacement cost for each asset class and component.

- Step 3 – Deflate the Current Replacement Cost:

Deflate the current replacement cost based on the asset age data collected in Step 1 to obtain estimated historic costs. Appendix 4.B discusses the treatment of inflation.

An agency decides that to maintain consistency with its financial reporting, the agency should use historic costs rather than current replacement cost. However, historic cost data are not consistently available. Thus, the agency decides to use the Wooster Method to estimate historic costs. Table 4-3 shows the application of this method for a selected set of assets using unit cost of $5 million per lane mile (as obtained in Example 4-1). The unit cost developed as described in Example 4-1 is applied and deflated to estimate historic costs. In this hypothetical example the total replacement cost is $3.9 billion in constant 2020 dollars and $2.0 billion in year of expenditure (historic) dollars.

Table 4-3. Estimation of Historic Costs of Pavement Reconstruction

| Route | Lane Miles (LM) | Year Constructed | 2020 Cost ($M) | Historic Cost ($M) |

|---|---|---|---|---|

| 11 | 96 | 2001 | 480.0 | 265.5 |

| 11 | 128 | 2004 | 640.0 | 397.1 |

| 22 | 72 | 1989 | 360.0 | 144.9 |

| 22 | 192 | 1996 | 960.0 | 470.5 |

| 33 | 32 | 2000 | 160.0 | 86.8 |

| 44 | 44 | 2003 | 220.0 | 128.4 |

| 44 | 8 | 1997 | 40.0 | 20.3 |

| 55 | 128 | 1990 | 640.0 | 264.1 |

| 66 | 28 | 2001 | 140.0 | 77.4 |

| 77 | 52 | 1999 | 260.0 | 137.4 |

| Total | 3,900.0 | 1,992.7 |

Neither historic costs nor asset age can be reliably obtained at an asset level. Overall expenditures by work type and system are used as the basis for calculating asset value without relating expenditures to specific assets.

An asset inventory is available detailing asset age. Historic costs are not reliably tracked by asset but can be estimated using unit replacement costs and asset age

Actual costs of construction/asset purchases are tracked by asset.

The analysis is limited to asset purchase or construction and reconstruction. Asset reconstruction is assumed to have the same cost and effect as initial construction.

Treatment costs are established through a one-time analysis of project data and updated in subsequent years based on inflation. Treatment effects are based on expert judgement or a one-time analysis.

Treatment cost and effects are established through a well-documented process that includes: analysis of treatment data; assessment of how assets should be grouped for analysis (e.g., by system, material, and/or surface type); and a defined update cycle (e.g., once every 1 to 2 years).

Condition data are sufficient for estimating the condition distribution at a network level. Condition is mapped to effective age and depreciation is calculated by asset class based on current condition.

An assessment is performed to determine how best to calculate effective age, potentially using actual age and/or condition. Depreciation is calculated based on effective age by asset class, asset and/or component.

An analysis is performed of the consumption of asset benefits. A custom pattern of benefit consumption is used if supported by the analysis. Otherwise, an assessment is performed to determine how best to calculate effective age, potentially using actual age and/or condition. Depreciation is calculated based on the selected approach by asset class, asset and/or component.

The agency prepares a balance sheet as part of its financial reporting, but does not attempt to reconcile asset value in the financial report with TAM estimates.

Differences in approaches between financial reporting TAM asset valuation are documented as a one-time exercise performed when preparing the TAM asset valuation.

Consistent approaches are used where possible to prepare the balance sheet in the agency’s financial report and value assets for TAM. Differences in approaches are resolved where possible, and regularly reviewed and documented in financial and TAM reports where they remain.

The cost to maintain current asset value is calculated using annual depreciation and reported in the agency’s TAMP.

The cost to maintain current asset value is calculated using the agency’s management systems. The cost to maintain and ASR are reported in the agency’s TAMP.

The cost to maintain current asset value is calculated using the agency’s management systems. The cost to maintain and ASR are reported in the agency’s TAMP. The cost to maintain and ASR are reviewed when establishing asset investment levels.

The price of an asset if offered for sale in a competitive market.

- Step 1 – Establish Whether a Competitive Market Exists:

Evaluate whether a market exists for a given asset or group of assets. A market is likely to exist in cases where the asset can be readily transferred between owners, such as for vehicles and equipment. A market may exist if a private concession has been proposed or implemented. The market can be competitive if there are multiple potential buyers and/or multiple sellers in the market.

- Step 2 – Identify Applicable Assets:

Specify the specific assets for which a market price can be established. In the case where value is established through the price of a private concession, the price may be specific to a small group of assets – e.g., the pavement and bridges that are part of a toll facility.

- Step 3 – Adjust the Market Price for Inflation:

If the market price is not current, it should be adjusted for inflation. See Appendix 4.B for a discussion of the treatment of inflation. Once the market price has been adjusted, it represents the current value for the selected assets.

- Step 4 – Value Other Assets Using the Replacement Cost Method:

Where market price can be calculated for only a subset of the assets being included in a calculation, the initial value for other assets should be calculated using the current replacement cost approach.

A transit agency has a fleet of over-the road transit buses purchased at different times from the same manufacturer. The agency seeks to establish the value of these buses using market value. Table 4-4 is a list of used coach buses from a selected manufacturer available for sale from an online bus reseller. It shows the age, mileage and price of each bus offered for sale.

Table 4-4. Over-the-Road Coach Buses Available for a Selected Manufacturer and Reseller

| Bus | Age (years) | Mileage | Prices ($) |

|---|---|---|---|

| 1 | 7 | 650,000 | 239,900 |

| 2 | 9 | 181,000 | 234,900 |

| 3 | 12 | 288,000 | 149,900 |

| 4 | 14 | 305,000 | 204,900 |

| 5 | 14 | 399,899 | 239,900 |

| 6 | 15 | 350,000 | 69,900 |

| 7 | 18 | 550,567 | 32,500 |

| 8 | 22 | not listed | 25,000 |

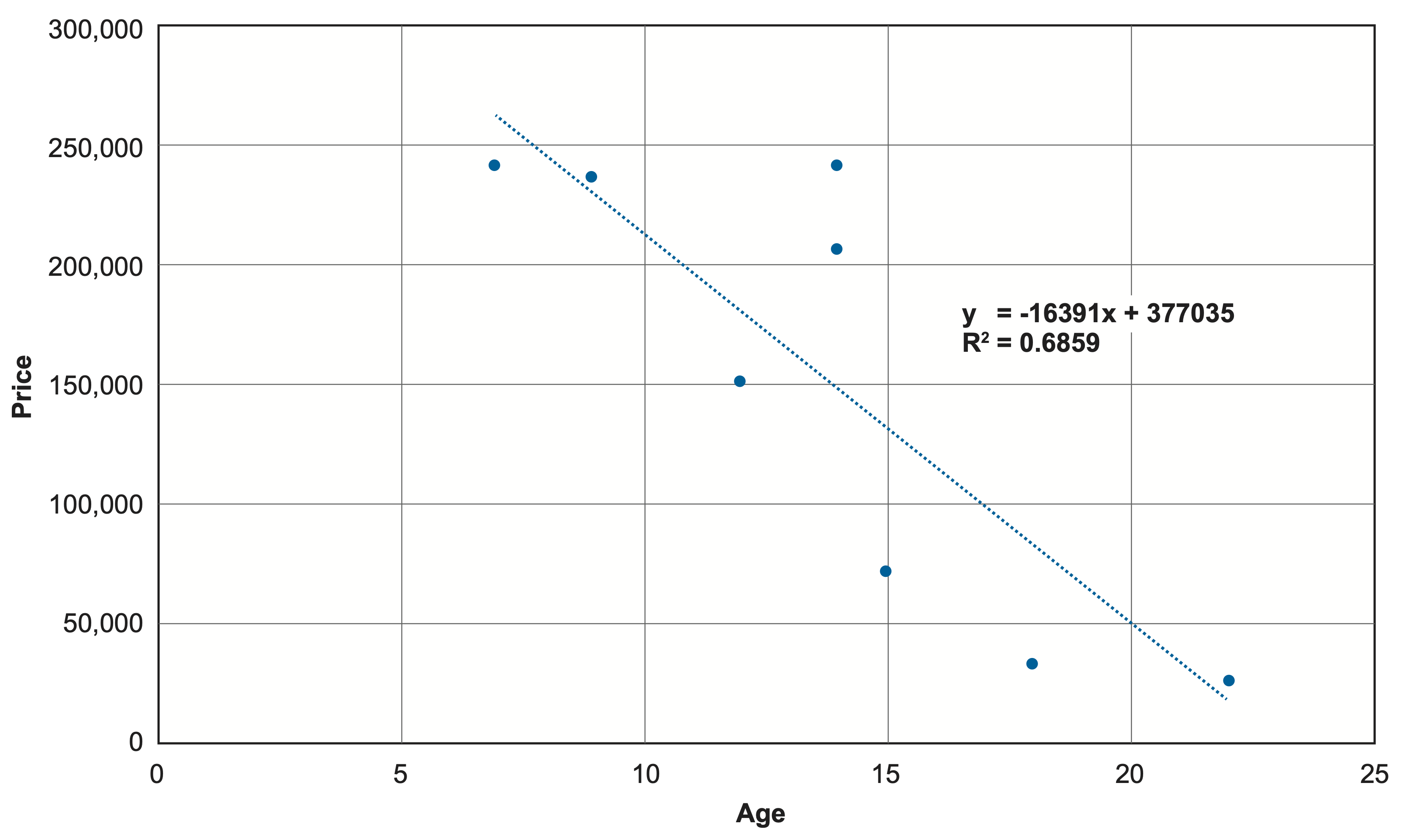

The agency uses the data in the table to construct a simple linear model for predicting the price of a used bus. In this case, price is predicted as a function of age using the following relationship:

Price = 377,035 - 16,391 * AgeFigure 4-2 shows the resulting model.

Note that alternative models were tested including both mileage and age, and substituting mileage for age. In this case the age-based model provides the best fit. In practice price may depend on a number of age, mileage, and other variables.

Market value is estimated based on expert judgement and/or industry defaults.

Market value is established through a one-time analysis of asset resale or other data and updated in subsequent years based on inflation.

Market value is established through a well-documented process that includes: analysis of asset resale or other data; assessment of how assets should be grouped for analysis (e.g., by system, material and/or surface type); and a defined update cycle (e.g., once every 1 to 2 years).

Asset useful life is estimated based on expert judgement and/or industry defaults.

A one-time analysis is performed to establish asset useful life based on analysis of historic data and/or asset models.

Asset useful life assumptions are based on models used in an agency’s management systems. The assumptions are periodically validated and updated through a well-documented process.

Cost to maintain current value, ASR and asset ACR are or can be calculated using annual depreciation and expenditures.

Cost to maintain current value, ASR and asset ACR are or can be calculated using annual depreciation and expenditures. In addition, supplemental analysis is performed using the agency’s management systems to establish the cost to maintain current value.

Cost to maintain current value, ASR, ACR and AFR are calculated and used to support investment decisions. Supplemental analysis is performed using the agency’s management systems to establish the cost to maintain current value and the cost to achieve the desired state of good repair.

Needed funding is reported in the agency’s TAMP. Needed funding is assumed to be equal to the cost to maintain current value.

A separate analysis is performed using the agency’s management systems to support the calculation of the funding needed to achieve and maintain the agency’s desired state of good repair.

A separate analysis is performed using the agency’s management systems to support the calculation of the funding needed to achieve and maintain the agency’s desired state of good repair. Needed funding is considered in establishing asset investment levels.

The present value of future benefits an asset to the asset users or owners.

- Step 1 – Define the Assessment Scope:

Establish the set of assets to be analyzed. Define the with- and without-project contexts. Demarcate the breadth of the analysis geographically and temporally.

- Step 2 – Identify Potential Impacts:

Select the variables, or categories of impact, which will have an impact on the user and non-user benefits and disbenefits. Consider the characteristics of the asset, its users, and the community surrounding it. Options include travel time, vehicle operating costs, safety, pollution, asset maintenance, and wider community impacts, among others.

- Step 3 – Evaluate and Collect the Data:

Assess the data necessary to measure the potential impacts. Understand the trade-offs between stronger data collection and collection costs. For the chosen datasets, convert the impact categories into impact factors and impact value per unit.

- Step 4 – Project System Use:

Use current and historic traffic or passenger counts to understand the trends in the volume of vehicles and passengers. Predict the use of the system with and without investment, such as through use of a travel demand model.

- Step 5 – Calculate the Economic Value:

Using the output of the demand models and the impact data, weigh the benefits and costs of the with- and without-project contexts. Monetize impacts and apply a discount rate to bring benefits and costs into present value, and, if assessing a large transportation asset, account for the residual value at the end of the time period. Compare the two project scenarios to understand the value of the proposed changes.

An agency is interested in using asset value to help prioritize reconstruction of a set of bridges to improve resilience. After discussing the cost, market and economic perspectives on asset value, agency leadership determines that the economic perspective is needed for this application. This perspective can help compare the benefits to society of reconstructing different bridges. Agency staff adapt the bridge screening approach established in FHWA’s National Bridge Investment Analysis System (NBIAS) to estimate asset value (32).

The approach used by NBIAS is to calculate the benefit of a bridge as the savings in travel and operating costs relative to that which would be incurred if all vehicles were detoured around the bridge. The calculation is made for autos and truck, and summed over time, applying a discount rate. The approach utilizes data available for U.S. highway bridges in the National Bridge Inventory (NBI) along with a small number of additional parameters. The following equations detail the calculation:

\begin{align*} B_a &= 365.25*T [ \frac{\tau}{100}(L C_l^t + \frac{L}{v_d} C_h^t) + (\frac{100-\tau}{100})(L C_l^t + \frac{L}{v_d} C_h^c)] \\ B &= B_a \sum_{i=1}^{N} \delta^{(i-1)} \end{align*}where:

Calculations of economic value rely on estimates of detour distance and speed to estimate changes in user costs from addition or removal of an asset, but do not attempt to quantify the impact of changes in travel demand.

Calculations of economic value rely on estimates of detour distance and speed to calculate changes in user costs from addition or removal of an asset. The elasticity of travel demand is used to estimate changes in traffic volumes.

Calculations of economic value utilize travel demand models to quantify impacts of potential changes to the network from addition or removal of an asset.

The analysis is limited to asset purchase or construction and reconstruction. Asset reconstruction is assumed to have the same cost and effect as initial construction (resulting in a residual value of 0).

A determination is made for each asset class and component concerning whether to calculate residual value based on salvage value or the difference between asset construction and reconstruction. Salvage values are established based on expert judgement.

A determination is made for each asset class and component concerning whether to calculate residual value based on salvage value or the difference between asset construction and reconstruction. Salvage values are established based on analysis of historic data.

Asset value is reported by asset class and system in the agency’s TAMP or supporting documents.

Asset value and supporting measures such as the cost to maintain current condition, ASR, AFR and ACR are reported by asset class and system in the agency’s TAMP or supporting documents.

Asset value and supporting measures such as the cost to maintain current condition, ASR, AFR and ACR are reported by asset class and system in the agency’s TAMP or supporting documents. Information on asset value and related measures is used to support decisions concerning the allocation of funding between asset class and system.