Thus far, we have discussed how asset value can be used to support TAM but not what it actually represents. This begs the question, what is asset value? According to the definition established by Organisation for Economic Co-Operation and Development (OECD), in its report Measuring Capital (11), a physical asset has no intrinsic value. Instead, its value results from the benefits it yields, be they to the asset owner, a set of transportation system users, society as a whole, or some combination thereof. As an asset ages, it depreciates, or loses value, when its benefits are consumed.

Speaking generically about capital and its value, OECD discusses that capital has a dual nature; it serves both as a means to store wealth and as a source of capital services. OECD further discusses the different perspectives on asset value as well as the fact that the best perspective depends on one’s “analytical purpose.”

Asset Value: the discounted stream of future benefits that the asset is expected to yield.

Depreciation: loss in the value of an asset as it ages, equivalent to the consumption of fixed capital.

Source: OECD, Measuring Capital (11)

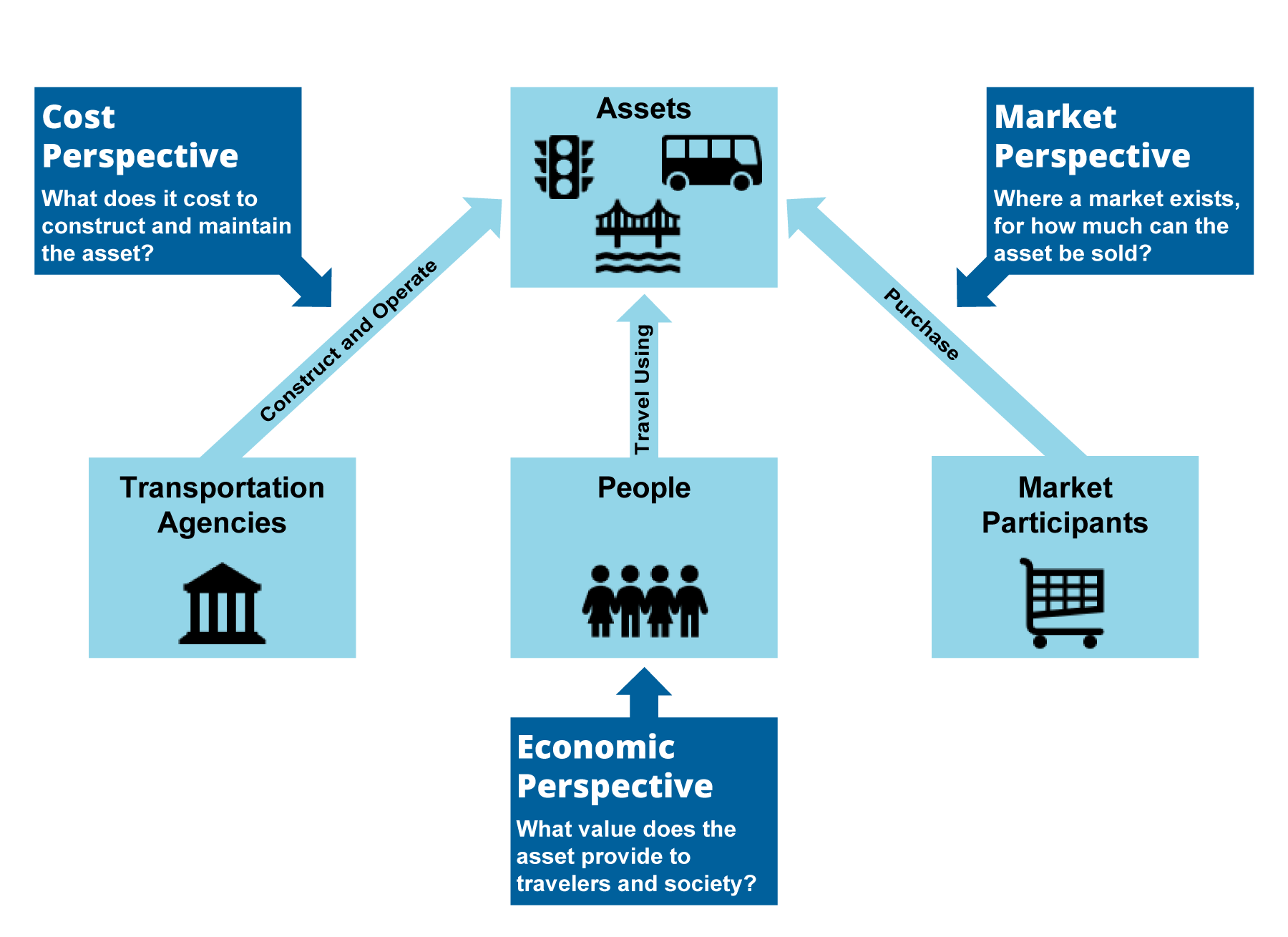

Figure 2-4 illustrates the different perspectives on transportation asset value, adapting concepts from the OECD discussion. The figure illustrates three perspectives: a market perspective, a cost perspective, and an economic perspective. Each perspective is discussed further below.

The cost perspective focuses on capital costs incurred by the asset owner. When establishing value from this perspective one asks: “How much does it cost us to acquire this asset and operate it over time?”

In cases where a competitive market exists for an asset, the cost and market perspectives yield the same result for the initial value of an asset; the cost is notionally the price of the asset on the market. However, this perspective still yields a value in cases where no market exists, or where the market is not competitive. Even if there is no market for an asset, there is still a cost incurred in purchasing, constructing, and operating the asset over time.

One important consideration in adopting the cost perspective is to establish whether to use historic or current costs. The historic cost of an asset is the cost that was actually paid for the asset. The current cost is the cost of replacing the asset in today’s dollars, regardless of what was actually paid in the past. GASB Statement 34 specifically requires agencies to report the historic costs of asset purchase or construction, as is consistent with U.S. Generally Accepted Accounting Principles (GAAP). U.S. GAAP emphasize the use of conservatism, or avoiding the overstatement of net assets and income. Thus, U.S. agencies must report asset values using historic costs or estimated historic costs in their financial reports to be consistent with either method in GASB 34, even if they calculate value in other ways to support TAM.

For supporting TAM, and for financial reporting outside the U.S., asset owners tend to use the asset’s current replacement cost in today’s dollars rather than the asset’s purchase price. The use of the current replacement cost is recommended for calculating the fair value of an asset as defined in IFRS Number 13. This cost is used as a proxy for the price that would be charged for the asset in the event that a market existed. Also, it is the cost that is most relevant to an asset manager trying to make investment decisions that involve spending money in today’s dollars.

The basic issue with the cost perspective is that it leaves no daylight between cost and value; these are one and the same. If one asks what value will be derived from spending $1 million to reconstruct a road, from the cost perspective the answer is “$1 million, of course.” Consequently, the cost perspective can help answer questions about how best to manage assets, but it is ill-suited for addressing questions concerning the underlying value of transportation assets to society. For answering such questions, one must instead turn to the economic perspective.

The market perspective focuses on the price of an asset on the open market. When establishing value from this perspective one asks: “For how much can an asset be sold on the market?” For example, when valuing an automobile one might seek to determine the resale value should the car be sold through an auction or to a reseller.

The virtue of this perspective is that it leverages the behavior of free markets to determine how much value an asset is expected to yield in the future. If the market for an asset is competitive, then the asset’s market value should theoretically account for the future benefits provided to the buyer. After all, nobody would want to purchase an asset at a cost greater than its expected benefit. The competitive nature of the market should ensure that no asset is sold at less than this value. Thus, this perspective is extremely valuable where a well-defined market exists for an asset.

The challenge with adopting this perspective is that it can be hard to identify a market, let alone a competitive one, for many types of transportation assets. Markets typically exist for assets that are manufactured and can be readily exchanged between different parties, including many types of vehicles, equipment, facilities, and land. Fixed assets, such as the roads and bridges necessary to provide mobility to society, are not particularly mobile themselves, and they do not lend themselves to being resold once constructed because they do not generate revenue. Markets can exist for toll roads and bridges, but it is important to note that the prices in these markets may not be wholly indicative of the asset’s condition, as they typically involve the leasing, not the sale, of an asset for an allotted period of time. Also, the market price does not account for externalities – costs and benefits placed upon others and not perceived by the buyer. An example of a positive externality is the support of emergency services such as ambulances; negative externalities include items such as air pollution, congestion, and noise. Depending on the application, it may be necessary to adjust the market price for externalities.

One approach for calculating a market value for fixed assets is to examine cases in which infrastructure has been privatized, such as where a private firm bids to own, operate, and maintain a highway. The asset value considerations and applications for private infrastructure are explored further in Chapter 4. For now, to use this as the basis for establishing value for other assets one must ask:

- To what extent can the price of a given privatization contract or other transaction be generalized to other transportation assets? For instance, it may not be reasonable to apply the value of a specific toll road to other non-toll roads and bridges. These assets’ risks, costs, and revenues depend on unique characteristics, such as the length of the contract or local traffic flow, which are not easily generalized or tracked.

- Does the market price account for the full range of benefits and externalities? In the example of a toll road, one can use the transaction price to determine the value of future tolls for a specific road. However, this does not account for impacts of traffic diverted to or from other roads as a result of the toll road, changes in consumer surplus to road users being tolled, environmental impacts, and a host of other issues.

- Is the market competitive? Certainly, a public agency awarding work always seeks a competitive market, but in large, high-cost bids there may be a small number of bidders, and it may be difficult to establish whether a competitive market actually exists. If the market exists but it not competitive, then it is possible to establish a market price, but it may be a different price than that of a truly competitive market.

However it is established, the market value of an asset is viewed as the best representation of asset value based on international accounting guidance. Based on the IFRS 13 standard, the fair value is the price that would be set for an asset in a market, in the event one existed, regardless of whether such a market actually exists. Where no such market exists, IFRS 13 describes using the cost of the asset as a proxy, consistent with the cost perspective.

Fair Value: the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Source: IFRS, Standard Number 13: Fair Value Measurement (3)

The economic perspective focuses on the benefits generated by an asset. When establishing value from this perspective one asks: “What are the benefits of the asset to travelers and society?” In general guidance for asset value (11, 12), this perspective is also called the “income perspective”, as it involves calculating the income generated by an asset.

The valuation of an asset is a fundamental area of economic analysis, especially in the context of a benefit-cost analysis (BCA) conducted to determine whether improvements to an asset are worthwhile. When conducting a BCA, one determines the cost of an investment as described above for the cost perspective and calculates economic benefits by observing the choices people make to infer the value they derive. Transportation facilities do not intrinsically generate value. Instead, value is generated when a facility is used to transport people or goods. Analysis of the different values incorporates forecasts of roadway uses, which are typically obtained from travel demand models that frame transportation choices through a nested set of decisions, including whether or not to take a trip, and if the trip is taken, which destination, mode, and route is chosen. Since operating a wide network of roadways expands transportation choices, and thus the implicit value of exercising an option to travel, a fundamental purpose of asset management is to maintain existing facilities so that their use generates value.

The cost, market, and economic perspectives on asset value differ in subtle and important ways. For example, a cost perspective generally starts from an implicit assumption that a facility is worth maintaining at the level of service for which it was originally planned and constructed. The actual use of the facility does not factor into the assessment except when it is used to indirectly estimate the rate of deterioration and maintenance schedule. In comparison, the market approach directly considers the value of the facility to users in addition to the cost to maintain it. The market approach can be considered from the perspective of a concessionaire who could evaluate the facility based on their opportunity to recover their cost and earn a profit, through revenue collection. Accordingly, the number of users and their willingness to pay for using the facility are key determinants of value. Note also that this willingness to pay is typically associated only with users’ potential for saving time or out-of-pocket costs.

In contrast, an economic measure of asset value stems from a more comprehensive value, based on the use of a facility. Economic asset valuation is an analytical exercise that establishes a rationale on whether and when a facility ought to be constructed or improved. Academic literature and practitioner-oriented documents and guidelines discuss two ways in which a transportation facility provides economic value (13, 14). A user-based measure of value draws directly from separable and additive accounting of key benefit categories, such as travel time, out-of-pocket expenditures, accident risk, pollutant externalities, and pavement maintenance, and some potential site-specific impacts that arise from facility use or location. Alternatively, where transportation facilities lower the cost of mobility, they can induce more productive investments in capital and labor, key measures of gross domestic product (GDP), and a macroeconomic indicator of transportation value. There are various challenges in linking economic benefits to specific changes in GDP. The approach presented here addresses the economic benefits of transportation assets without making an explicit linkage between these benefits and GDP.

There are several important dimensions in a user-based, economic valuation of transportation assets that one must consider when valuing assets from an economic perspective. These include the following:

- Relative value. Since a transportation facility has no intrinsic value (beyond its use), economic valuation of an existing facility constructs a counterfactual case (e.g., an alternative design, route or mode) for comparison with current conditions. Depending on the asset management context, several different types of alternatives could be established for comparison.

- Measures of value. Transportation investment has a number of different impacts both positive and negative. A variety of different measures are needed to quantify the value from an investment. These include, but are not limited to, travel time savings, vehicle operating costs, crash costs, emissions costs, costs from environmental impacts, changes in property value, and agency costs.

- Consideration of the stream of costs and benefits. The time span over which asset value is measured creates complexities since many roadways are already or will become long-lasting corridors that communities develop around. The present value of a facility’s future uses must be determined, and this is directly determined by a discount rate intended to reflect the present value decision-makers place on any future uses.

- Changing contexts. It is not enough to manage assets assuming current valuation conditions will remain in perpetuity. For example, the value of a transportation asset may change if policy perspectives shift toward free-access facilities versus revenue-generating ones or if climate conditions render facilities more vulnerable to extreme events.

Each asset value perspective emphasizes a specific aspect of how transportation assets are constructed and utilized. All three perspectives are valid, and can provide insights that help communicate information about assets and support decision-making.

While each of the perspectives supports some of the applications described in Section 2.1, many public agencies rely on the cost perspective for their calculation of asset value. The cost perspective helps an agency directly relate its expenditures on assets to changes in their value, and it supports a large number of TAM-related applications. Also, where a market exists, the cost of replacing the asset, depreciated based on its age or use, tends to correlate closely to its price. Where no market exists, the depreciated replacement cost serves as a proxy for its market price.

Regarding the relationship between the cost and economic perspectives, the cost of an asset does not provide direct insight into the economic benefits generated by an asset, and cannot support decisions that rely on this information. However, if one assumes that an existing asset is worthy of maintenance, the expectation is that its benefits over time must at least equal, and may greatly exceed, its replacement cost. Further, whatever the benefits may be to transportation users and society, those benefits will continue to accrue provided the asset remains in service. Thus, for many TAM applications it is sufficient to focus on the cost to the agency of keeping the asset in service through efficient maintenance and planning, with the assumption that doing so is inherently worthwhile.