Determining the value of a transportation organization’s physical assets is important for both financial reporting and transportation asset management (TAM). In financial reporting, determining asset value is a fundamental step in preparing a balance sheet for financial statements to inform regulators and investors. For TAM, presenting data on the value of physical assets, such as pavement, bridges, and facilities, communicates what an organization owns and what it must maintain. Furthermore, information about asset value and how it is changing can help establish how the organization is maintaining its asset inventory and helps support investment decisions.

Calculating asset value for TAM is not simply good practice; it is also required of state Departments of Transportation (DOT) by Federal regulations. Title 23 of the Code of Federal Regulations (CFR) Part 515 details requirements for State DOTs to develop a risk-based Transportation Asset Management Plan (TAMP).

These regulations, initiated by the legislation Moving Ahead for Progress in the 21st Century (MAP-21), include a requirement for DOTs to calculate the asset value for National Highway System (NHS) bridges and pavement in their state. DOTs must also determine the cost required to maintain the value of their NHS assets.

To comply with the Government Accounting Standards Board (GASB) Statement 34, agencies also record their assets’ book value in annual financial reports. GASB 34 allows for either a standard (i.e., historic cost with straight-line depreciation) or modified approach. Many agencies struggle to reconcile financial asset valuation for GASB reporting with asset valuation for the purposes of asset management and the TAMP.

Reporting asset value is required in various documents, such as the financial reports of U.S. public agencies, which are prepared to comply with General Accounting Standards Board (GASB) Statement 34 (1), and National Highway System (NHS) transportation asset management plans. However, there are many nuances concerning how to perform the calculations, and a variety of different approaches has been used in the past for different applications.

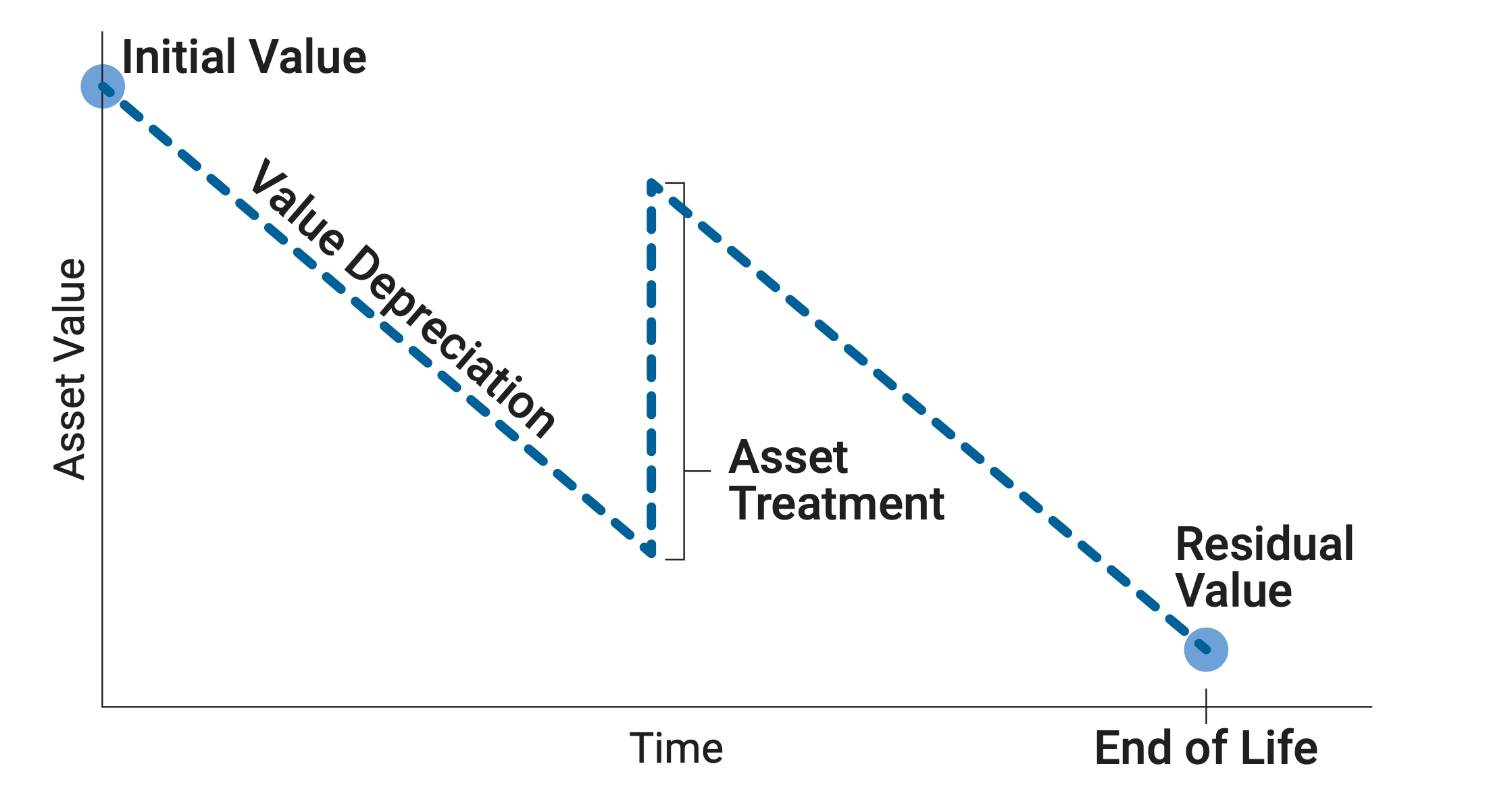

Figure 1-1 depicts the value of an asset over time, and illustrates the different facets of the value calculation. The left side of the figure shows the value of the asset when it is first constructed or obtained. Over time the asset value tends to decline. The amount of value the asset loses, also called depreciation, represents the consumption of the asset’s benefits. If treatments are performed that extend asset life, such as rehabilitation, then the asset may regain some or all of its value. When the asset reaches the end of its life, it is valued at its residual value, also called salvage value.

At each step of the asset value calculation illustrated in the figure, an analyst may choose how to perform the calculation. Specifically, he or she may use different approaches for calculating the initial value of an asset when first constructed or obtained, for establishing how value depreciates, for determining what treatments should be considered in the calculation and what their effects are, and for calculating residual value.

In truth there is no single correct way to calculate asset value, and there are good reasons why one may choose one approach over another or how much detail to incorporate into the calculation. The different approaches result from the fundamental considerations an analyst faces. These include:

- Different applications of asset value. The best approach for calculating asset value depends on how the valuation will be used. A private company may be interested in establishing fair market value of its assets to determine the profit to be gained by selling them. For public agencies, the primary purpose of financial reporting is to provide an accurate account of how the agency is spending resources to ensure the agency is financially sound and following regulations. In TAM, asset value supports decisions regarding investments to maintain and extend the life of assets. Another application of asset value is using it to understand the economic benefit or cost of the transportation system to society.

- Tension between simplicity and complexity. Often, improving a given approach to calculating asset value requires more data and/or more intensive calculations. For instance, straight-line depreciation is frequently used to determine asset value over time for the financial asset register. However, one can arguably obtain a more meaningful and useful estimate of depreciation for TAM applications by utilizing data on asset condition to establish asset value for the technical asset register. In these situations, it is important to balance the desire for a more accurate calculation with the benefit of having a simple, repeatable, and sustainable approach.

- Limits on what a single measure can provide. Once calculated, the value of an asset provides a powerful and compelling measure. Yet no single number, however well-conceived, is sufficient for conveying all of the information one may wish to communicate regarding an asset. Thus, a valuation approach should be adapted so that it provides the information of greatest use in decision-making. For instance, an agency may wish to tailor the calculation such that annual depreciation approximates the cost to maintain asset value. However, this limits the ability to use the change in asset value in other ways, such as for showing how a proactive preservation strategy could be more cost-effective than a reactive strategy.

The objective of this guide is to provide step-by-step guidance for calculating asset value in support of asset management applications. It describes an approach to calculating value that includes six basic steps, offering alternative approaches for each step to account for the considerations described above, as well as for differences in the scope of the calculation, available data, and other factors.

It is important to note that while the guidance presented here is intended to be consistent with best practices in public sector accounting, this document is not intended as an accounting standard or as a guide for calculating asset value in support of agency financial reports. Several accounting standards exist for valuing assets to support financial reporting that do address these topics. The predominant standard for U.S. public agencies is the aforementioned GASB Statement 34 (1), and its international counterpart is the International Public Sector Accounting Standards (IPSAS). IPSAS standards are based on standards of the International Accounting Standards Board (IASB), particularly International Accounting Standard (IAS) 16: Property, Plant and Equipment (2) and International Financial Reporting Standard (IFRS) 13: Fair Value Measurement (3). International Standards Organization (ISO) 55002 asset management standard (4) discusses additional important concepts for relating asset value to asset management, such as the distinction between value generation and value determination. While important to the industry and general understanding, these standards are not the focus of this guidance.

The recently-updated ISO55002 standard discusses the differences between value generation, the benefits from use or ownership of assets defined as “value from”, and value determination, an asset’s valuation for purposes of sale defined as “value of.”

Using a rental car company as an example, rental vehicles lose sale value (“value of”) immediately after purchase, but the company continues to generate value (“value from”) by renting their cars to users. The rental car company is then able to make a profit from assets which are losing value. In traditional business cases, asset owner investment decisions are more often guided by “value from” than “value of.”